The wealthy have played by a different set of rules for years. You see real estate tycoons and founders living large, but they rarely sell their stuff to pay for it.

Why? Because selling triggers a tax bill that stops their money from growing. Instead, they use a strategy called Buy Borrow Die Bitcoin.

Traditionally, you needed a massive portfolio of stocks or a few skyscrapers to pull this off. But today, Bitcoin has changed the game. It is the perfect collateral for the 21st century, and it opens this door for the rest of us.

If you are planning your FIRE (Financial Independence, Retire Early) journey, you have a choice to make. Do you sell your Bitcoin to pay for groceries, take the tax hit, and watch your stack shrink?

Or do you leverage your hard money to live tax-free while keeping your position intact?

In this guide, we will break down the Buy Borrow Die Bitcoin strategy, run the numbers using our InsightXO simulators, and look at the risks without the sugarcoating.

Key Takeaways

- Tax Efficiency: Borrowing against Bitcoin generates liquidity without triggering capital gains tax, as debt is not considered income by the IRS.

- Asset Retention: By not selling, you retain 100% of your Bitcoin’s upside potential, allowing asset appreciation to potentially outpace interest costs.

- Generational Wealth: The “Die” phase utilizes estate planning tools (step-up in basis) to pass wealth to heirs tax-efficiently, effectively wiping out deferred tax liabilities.

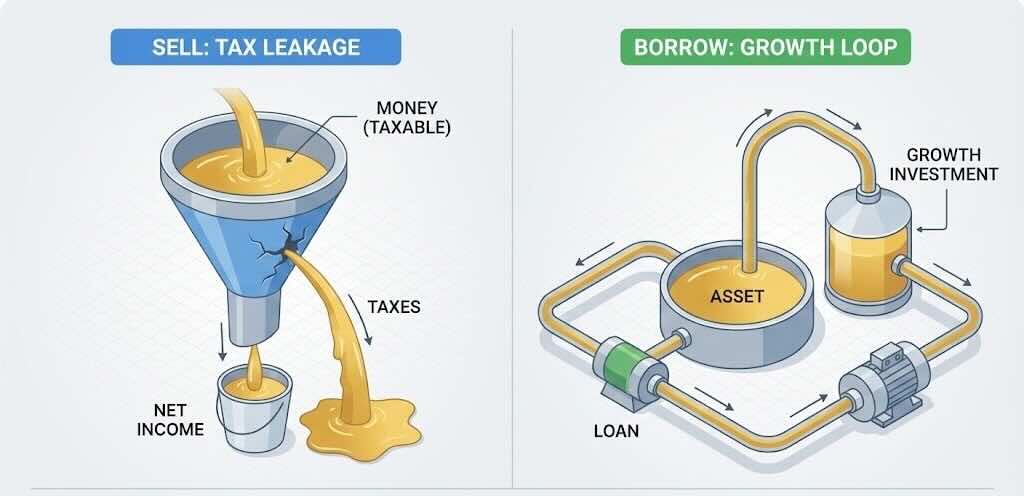

The Old Way vs. The Bitcoin Way

Most of us are taught a simple playbook: work hard, buy assets, and then sell them off piece by piece in retirement.

The problem with this approach? Taxes. When you sell an asset that has gone up in value, you owe Capital Gains Tax (15% to 20% + Net Investment Income Tax + state taxes).

Plus, you kill the compound growth potential of the asset you just sold. You are effectively slaughtering the goose that lays the golden eggs.

For a deeper look at how these taxes hit your wallet, check out the IRS Capital Gains and Losses guidelines.

The Buy Borrow Die Bitcoin Mechanics

It is simpler than it sounds

- Buy: You accumulate appreciating assets (Bitcoin).

- Borrow: Instead of selling, you take out a Buy Borrow Die Bitcoin loan using your Bitcoin as collateral. Debt is not taxable income. You get the cash you need, and you keep the Bitcoin.

- Die: This is the legacy part. When you pass away, your heirs receive a “step-up in basis,” resetting the tax liability. While crypto estate planning is complex, the big win remains: you lived your whole life without realizing capital gains.

The Math: Interest vs. Taxes

Paying interest sounds backward, right? Why pay a lender when you could just sell the asset? The answer is in the numbers. It is about the Cost of Capital versus the Cost of Selling.

Scenario: You need $50,000 for living expenses.

Option A: Selling Bitcoin

- Action: You sell $50,000 worth of BTC.

- Tax Impact: Depending on your basis, you could owe roughly $7,500 to $10,000 in taxes.

- Opportunity Cost: That $50,000 worth of Bitcoin (approx 0.55 BTC at $91k price) is gone forever. If Bitcoin jumps 20% next year, you missed out on $10,000 of gains.

Option B: Borrowing Against Bitcoin

- Action: You deposit $100,000 worth of BTC as collateral (50% LTV) to borrow $50,000.

- Interest Rate: Let’s assume an 8% APR.

- Interest Cost: $4,000 per year.

- Tax Impact: $0.

- Asset Position: You still own the Bitcoin. If it goes up 20%, your collateral value hits $120,000. That growth effectively pays off your interest expense.

Here is the bottom line: As long as your Bitcoin’s Annual Growth Rate (CAGR) beats the Loan Interest Rate, the Buy Borrow Die Bitcoin strategy puts you ahead mathematically.

Step 1: The “Buy” Phase (Accumulation)

Before you can borrow, you need a stack. Lenders want to be safe, so they require over-collateralization.

If you want to borrow $50,000 a year to live on, you generally need about $150,000 to $250,000 in Bitcoin to keep your Loan-To-Value (LTV) ratio in the safe zone.

Let’s look at a realistic scenario for a US-based investor using our Bitcoin DCA Calculator.

Case Study: The “Aggressive Accumulator”

- Profile: Michael, Age 30.

- Goal: Build a collateral stack in 10 years to borrow against at age 40.

- Monthly Investment: $500

- Current BTC Price: $91,000 (Base Data)

- Projected Growth: 20% CAGR (Conservative Estimate)

By sticking to a disciplined DCA strategy of $500/month, Michael builds up a solid nest egg. This “property” is the foundation you need to launch the Buy Borrow Die Bitcoin plan.

Step 2: The “Borrow” Phase (LTV Management)

This is where the magic happens. Instead of selling that Bitcoin to pay rent, you deposit it into a lending protocol and take a loan in stablecoins or USD.

Understanding Loan-to-Value (LTV)

Think of LTV as your safety margin. It is the ratio of your loan to your collateral.

- Collateral: $100,000 (Bitcoin)

- Loan: $20,000

- LTV: 20%

This is an incredibly safe level. Most liquidations happen when LTV hits 70% or 80%. By keeping your LTV below 30%, you can weather a massive Bitcoin crash—even a 50% drop—without losing your coins.

Managing these ratios is the single most important part of using Bitcoin backed loans safely.

Where to Borrow: The 2025 Landscape

To make this work, you need a partner you can trust. Here is who is out there right now:

| Feature | Coinbase (Morpho) | Ledn | Unchained Capital |

| Loan Structure | Hybrid (CeFi/DeFi) | CeFi (Centralized) | Native Multisig |

| Collateral | cbBTC (Wrapped) | BTC (Raw) | BTC (Raw On-Chain) |

| Key Advantage | Liquidity & Ease | Transparency | Security (Keys) |

| Risk Factor | Smart Contract / Frozen Asset | Counterparty Risk | Technical Complexity |

For a true Buy Borrow Die Bitcoin strategy involving your life savings, custody is the biggest variable.

You need to know if the lender is re-lending your coins (“Rehypothecation”) or keeping them locked up (“Segregated Storage”). You can read more about the risks of crypto lending on Investopedia.

Step 3: Simulation of Long-Term Sustainability

The big question: Will the money run out? Let’s use the Retirement Dashboard to simulate the withdrawal phase.

Note: The simulator below models a “Sale” of assets to calculate sustainability. In our Buy Borrow Die Bitcoin strategy, just think of the “Target Spend” as your “Yearly Loan Amount” plus interest.

Scenario Setup:

- Current Age: 35

- Retirement Start: Age 50

- Monthly Savings: $1,000

- Target Monthly Spend: $6,000 (Middle-class lifestyle)

- Post-Retirement BTC Growth: 8% (Conservative)

1. Accumulation Phase (Growth)

2. Decumulation Phase (Retirement)

Understanding the “Infinite Growth” Graph

You might notice something weird in favorable scenarios: the portfolio value line keeps going up and never hits zero. This is called “Portfolio Runaway.”

- The Math (Why):This isn’t a glitch. It’s the power of Positive Compounding. Because your Investment Return (say, 8%) is higher than what you are spending or borrowing (4%) plus inflation (3%), your money grows faster than you can drain it.

- The Reality Check (Risk):But real life isn’t a straight line. Bitcoin is volatile. If you face a “Sequence of Returns Risk”—like a 50% crash the year you retire—your LTV could spike dangerously high, forcing a liquidation.

- The Solution (Strategy):To make this chart a reality using the Buy Borrow Die Bitcoin method, you need a Cash Cushion. Keep 2-3 years of living expenses in Cash or Bonds. This way, you never have to post more collateral or get liquidated during a bear market.

Step 4: The “Die” Phase (Estate Planning)

This is the final step, and honestly, the one most people forget. Without it, the tax deferral is just temporary.

In the US tax system, when you pass away, your heirs get a massive benefit called a “step-up in basis.” This means the cost basis of the Bitcoin resets to its value on the day you die. This little detail in crypto estate planning is what creates true generational wealth.

Example:

- You bought BTC at $91,000.

- At death, that BTC is worth $1,000,000.

- Your heirs inherit it with a basis of $1,000,000.

- They can sell it immediately to pay off your loans and owe $0 in capital gains tax.

Warning: This requires a solid plan. You need a “Digital Executor” who knows how to access your keys. If your keys die with you, your wealth is gone. For more on this, check out guides on Forbes Finance.

Comparison: My Target vs. The 4% Rule

Are you borrowing too much? Let’s sanity check your numbers against the traditional “4% Rule” to see if your target spend is actually safe.

Frequently Asked Questions

Is the Buy Borrow Die Bitcoin strategy legal?

Yes, it is entirely legal. The US tax code does not consider loan proceeds as taxable income. Real estate investors have done this for decades, and now we are just applying it to digital assets via Bitcoin backed loans.

What are the risks of Bitcoin backed loans?

The big one is liquidation. If Bitcoin’s price crashes, your LTV ratio goes up. If it hits the limit (usually 70-80%), the lender sells your Bitcoin to cover the loan. You have to maintain a low LTV and keep a cash buffer to sustain the Buy Borrow Die Bitcoin plan during bear markets.

How much Bitcoin do I need to start?

To live off your assets safely, you generally need 4-5x your annual expenses in Bitcoin collateral. This keeps your LTV around 20-25%. So, if you need $50,000/year, you ideally need $200,000 to $250,000 in Bitcoin to execute Buy Borrow Die Bitcoin properly.

Conclusion: Don’t Eat Your Goose

The Buy Borrow Die Bitcoin strategy is the ultimate form of patience. It turns Bitcoin from a speculative lottery ticket into a perpetual wealth machine.

By borrowing against your Bitcoin at a conservative LTV, you get the cash you need today while keeping the massive upside of tomorrow. You are effectively stepping out of the tax system and into asset-based living.

But remember, leverage is a double-edged sword. Never max out your LTV. Always keep a healthy buffer. The goal is financial freedom, not sleepless nights worrying about a margin call.

Next Step: Want to see if you have enough Bitcoin to start this strategy? Use our Retirement Dashboard to calculate your “Safe Withdrawal Rate” and treat that number as your “Safe Borrowing Limit.”