For years, we have drilled one mantra into our heads: HODL.

We sacrifice today’s pleasures for tomorrow’s freedom. We stack sats relentlessly, endure bear markets, and lower our time preference. This discipline is essential for wealth accumulation in the early stages.

But there is a hidden risk in this hyper-disciplined mindset known as under-consumption.

Die With Zero: The Bitcoin Guide

Drawing from Bill Perkins’ philosophy in Die With Zero, we need to challenge the traditional notion of retirement. If you are sitting on a significant Bitcoin stack, the goal shouldn’t just be seeing the number go up.

The goal should be maximizing your life satisfaction.

Today, we explore Die With Zero Bitcoin strategies. We will use the InsightXO Simulators to calculate how to balance holding the hardest asset on earth with actually living a life worth remembering.

Key Takeaways

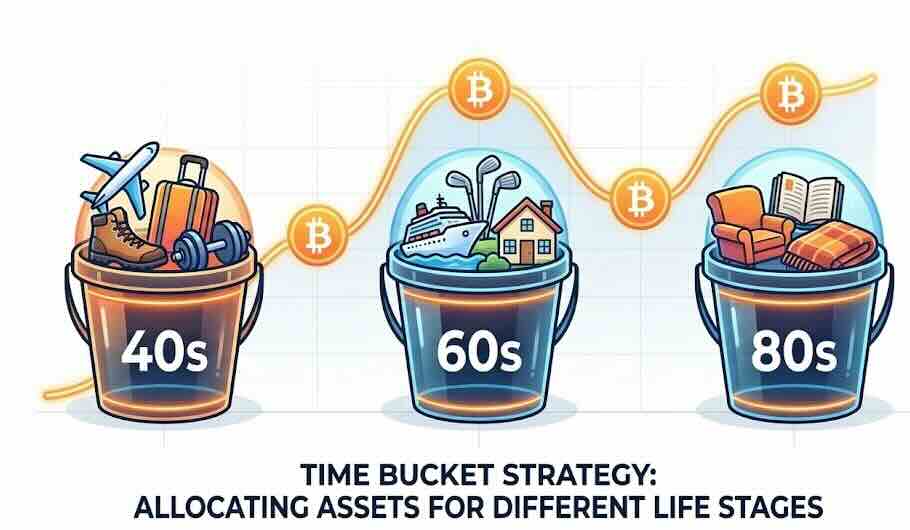

- The Utility Curve: Money has diminishing returns as you age; a Bitcoin spent at age 45 yields higher memory dividends than one spent at age 85.

- The Infinite Growth Glitch: Standard 4% withdrawal rules on high-growth assets often lead to unintentional over-accumulation, leaving millions unspent.

- The Cash Cushion Solution: To safely execute a Die With Zero Bitcoin strategy, you must hold 2-3 years of living expenses in cash to avoid selling sats during bear market drawdowns.

The Hoarder’s Dilemma: Wealth vs. Experiences

The core thesis of Die With Zero is simple. Money has diminishing utility as you age.

Spending $10,000 on a backpacking trip across Europe at age 30 yields a different return on experience than spending that same amount on a luxury cruise at age 80. The former creates decades of memories. The latter is merely comfort.

For investors following a Die With Zero Bitcoin approach, this dilemma is amplified by two factors.

First, the deflationary psychology makes spending painful. You know your 0.1 BTC will likely be worth significantly more in 10 years.

Second, the fear of running out is palpable. We have seen 80% drawdowns and hoard cash to protect against the next crypto winter.

However, if you optimize solely for net worth, you risk arriving at age 90 with a massive cold storage wallet but a body too frail to enjoy it. That is suboptimal capital allocation.

Case Study: The “Over-Saver” Simulation

Let’s run the numbers. We will analyze a typical late bloomer scenario.

This is someone who has a decent stack but is afraid to pull the trigger on retirement spending.

The Scenario: Mark, Age 45

Mark wants to retire in 10 years at age 55. He desires a Fat FIRE lifestyle costing $10,000 per month.

- Current Age: 45

- Target Retirement: 55

- Life Expectancy: 90

- Current Bitcoin: 1.0 BTC (Value: $86,000 at time of writing)

- Monthly Savings: $2,500

- Target Spend: $10,000/month

- Assumptions: 20% CAGR (Accumulation), 8% CAGR (Retirement), 3% Inflation.

Let’s use the Retirement Dashboard to see if Mark can afford to execute a Die With Zero Bitcoin plan or if he is on a path to die with too much.

Simulation 1: The Lifetime Consumption Path

1. Accumulation Phase (Growth)

2. Decumulation Phase (Retirement)

Analysis: The Cost of Being Too Safe

Look at the Decumulation Phase chart above.

If Mark sticks to the Safe Limit calculated by the simulation, his portfolio value continues to rise even while he is withdrawing funds. By age 90, he still has millions of dollars and a significant chunk of Bitcoin.

While this provides safety, it is a failure of optimization.

Mark denied himself experiences in his 60s and 70s to preserve capital that he will never use, essentially failing the primary goal of the Die With Zero Bitcoin philosophy.

The “Infinite Growth” Glitch: A Reality Check

You might notice the simulation graph shooting upward indefinitely in the safe scenario. This often confuses new users of the Die With Zero Bitcoin strategy.

The Math (Why):

This is not a glitch. It is the power of positive compounding. Because the projected Bitcoin growth rate (8% post-retirement) is higher than the withdrawal rate plus inflation (3%), the principal balance grows faster than Mark can spend it.

The Reality Check (Risk):

However, real life is not a straight line.

Bitcoin is volatile. If Mark faces a sequence of returns risk—such as a 50% crash immediately after retiring at 55—his portfolio could be depleted rapidly. You can read more about Sequence of Returns Risk at Investopedia to understand why early drawdowns are dangerous.

The Solution (Strategy):

To make this infinite wealth chart a reality, Mark needs a cash cushion strategy. He should keep 2-3 years of living expenses in cash or short-term bonds to avoid selling Bitcoin during bear markets.

Action Plan: How to Die With Zero Bitcoin (Without Going Broke)

So, how do we solve the Bitcoin decumulation strategy puzzle?

You don’t want to run out of money at 85, but you don’t want to leave 50 BTC on the table unspent. Here is a 3-step framework for Bitcoiners.

Don’t Die Rich & Unfulfilled

Invest in Memory Dividends Early

Don’t wait until you sell your Bitcoin to start living. Use a portion of your fiat cash flow now, in your 40s and 50s, to buy experiences.

Your health correlates with your ability to enjoy money. A ski trip at 45 is worth more than a luxury clinic visit at 85.

Implement the Cash Cushion (The 3-Year Rule)

To safely execute a Die With Zero Bitcoin plan without running out of money, you must immunize your essential spending from the bear market phases. The solution is the 3-Year Cash Cushion.

Bull Market: When Bitcoin rallies, take profits to refill your Cash Cushion to its full 3-year capacity.

Bear Market: When Bitcoin crashes, stop selling sats entirely. Live off your Cash Cushion.

Dynamic Guardrails

Forget the static withdrawal rules. Use a dynamic approach based on Bitcoin’s 4-year cycle.

If the portfolio rises by 20% in a bull market, increase your spending. If it falls, tighten your belt. This ensures you capture the utility of the bull run while surviving the bear.

Breaking the 4% Rule: Why Standard Advice Fails Bitcoiners

The traditional 4% Rule suggests withdrawing 4% of your initial portfolio annually, adjusted for inflation.

But for a high-growth asset class like Bitcoin, sticking rigidly to 4% might lead to massive over-accumulation.

Let’s compare Mark’s target spend against the strict 4% Rule using the 4% Rule Calculator.

Simulation 2: Target Lifestyle vs. 4% Rule

The gap is evident.

The 4% Rule leaves Mark with a massive portfolio runaway. He dies as a multi-millionaire, having lived like a middle-class retiree.

The Target Spend scenario, however, shows the portfolio declining. This is closer to the Die With Zero Bitcoin ideal. It creates anxiety for the holder, but it signifies maximum utility extracted from the asset.

FAQ

Optimized Bitcoin Spending Plan

Is “Die With Zero” risky for Bitcoin holders?

It can be if you do not manage volatility. The Die With Zero Bitcoin strategy requires a Cash Cushion of 2-3 years of living expenses to avoid selling Bitcoin during a 70% drawdown. Without this buffer, you risk depleting your stack prematurely.

How do I handle taxes when decumulating Bitcoin?

To optimize for a Die With Zero Bitcoin plan, consider selling High-In, First-Out (HIFO) lots first to minimize capital gains taxes in your early retirement years. Always consult a tax professional.

Does “Die With Zero” mean leaving nothing for my kids?

Not necessarily. You can allocate a specific Legacy Bucket of Bitcoin that you never touch. The “Zero” refers to your personal consumption bucket. It is often better to give assets to your children when they are 30 and buying a house rather than when they are 60.

Harvest Your Energy

Bitcoin is the greatest savings technology ever invented. It solves the problem of creating wealth.

But it does not solve the problem of using wealth. That part is up to you.

Do not let the HODL meme prevent you from optimizing your life. Use the Retirement Dashboard to find your safe limit, and then dare to spend slightly more on the things that truly matter.

Adopting a Die With Zero Bitcoin mindset ensures you don’t just leave a legacy on the blockchain, but in the memories of those you love.

After all, you can’t take your private keys with you.